When It Comes to Car Insurance We’ve Got You Covered.

Save Yourself From Unexpected Expenses With Car Cover

Statistics indicate highjackings were up by 64,000 in 2022, a car’s stolen every 22 minutes, and accidents occur every 10 minutes.

Is Car Insurance in South Africa Compulsory?

No, car insurance in South Africa isn’t compulsory, but it’s essential.

Car theft, highjackings, and accidents are rising yearly in South Africa, making car insurance a vital part of your daily driving life.

So Why Do You Need Car Insurance?

You need insurance for financial protection in the event of an accident and to avoid paying large sums of money for damages and injuries.

Choose a Car Insurance Policy That Suits You

We’ll help you find the best car insurance deals for your trailer, caravan, or motorcycle.

We’ll help you find the perfect provider.

Use our free car insurance calculator now.

We Are the Policy Experts

Fully Comprehensive

This insurance plan offers the highest level of protection, covering damages to all parties, personal injuries, and more, regardless of who's at fault.

Third Party, Fire & Theft

This policy covers damages to third parties, along with protection for your own vehicle in case of fire or theft.

Third Party Cover

This is the most basic level of car insurance, covering only the damages caused to other people's vehicles or property in an accident where you're at fault.

What Other Types Of Cover Can I Get?

Through design to protect, not all insurance plans for cars are the same.

You might want to look at…

Business Use Cover

Business use cover policies covers privately owned cars for work purposes.

Driving Abroad

Driving abroad is built for frequent far distance travellers who use their car.

Telematics Insurance

Telematics insurance is the process of assessing your driving to determine if you qualify for high or low premiums.

Short-Term Cover

Short-term insurance provides cover for individuals within a short period of time for what they need.

Multiple Cars

One owner can take out insurance plans for more than one car with multiple car cover.

Excess Protection

With excess protection, you only pay the excess of the damages of accidents or roadside emergencies.

Multiple Drivers

A policy option that covers more than one driver for the same vehicle.

Classic Car Cover

Specialised insurance is tailored to protect vintage or classic cars, often with agreed-value coverage.

Gap Protection

Insurance that covers the difference between the actual cash value of a vehicle and the balance still owed on the financing.

Breakdown Insurance

A policy add-on that provides assistance if your vehicle breaks down, such as towing or roadside repairs.

Courtesy Car

A feature of many policies is that they provide a temporary replacement vehicle while your car is being repaired.

Legal Expenses

Coverage for legal costs in case of a dispute related to a car accident or insurance claim.

Keys Lost or Stolen

Coverage for the cost of replacing car keys if they are lost or stolen.

Wrong Fuel Insurance

An add-on that covers repair costs if the wrong type of fuel is accidentally used in the vehicle.

No Claims Discount Protection

A feature that protects your discount for not making claims, even if you make a claim.

Personal Injury

Coverage for medical expenses and potential lost income resulting from a car accident.

Windscreen Repair & Replacement

Coverage for the repair or replacement of a damaged windscreen.

Flood Damage

Coverage for damages to your car caused by flooding or water-related incidents.

Personal Belongings

Coverage for personal items in your car that may be damaged or stolen.

Tyre & Rim Guard

An add-on that covers the cost of repairing or replacing your car's tyres and rims if they're damaged.

Motor Warranty

An insurance product that covers the cost of certain car repairs after the manufacturer's warranty expires.

Get the Best Value From Your Car Insurance

It’s best to compare car insurance with CarInsuranceCheck because it’s quick, easy, and safe.

We can carry out various quotes for the best value for money.

Click on the tab below and start comparing now!

Automated Quotes

CarInsuranceCheck provides automated quotes to help customers find the best car insurance deal in no time.

Compare Quotes Quickly

Get comparison quotes quickly and evaluate what option suits your financial situation best and what policy covers all your car's needs.

See Your Savings

Calculate your savings and benefits when comparing quotes with CarInsuranceChecker

Live Support

Get office hours support from one of our CarInsuraneCheck experts 7 days a week.

Why Do You Need Car Insurance?

Here are reasons why you should be covered on the road:

- Car insurance pays for all the damages.

- You can replace a stolen car.

- You get roadside assistance.

- Protects you and your passengers.

- You get fire protection.

- Get rewarded for good driving with discounts.

- Gives you peace of mind.

Spend Less & Save More

The cost of car insurance in South Africa varies greatly depending on numerous factors such as the driver’s age, driving history, the make and model of the car, and more.

At CarInsuranceCheck, we help you navigate these variables by providing a comprehensive range of quotes from top insurance providers.

Our user-friendly car insurance calculator simplifies the process, allowing you to find a cost-effective policy that suits your unique needs and circumstances.

Remember, it’s not just about finding the cheapest insurance, but the one that offers you the best coverage for your investment.

How Can You Get Cheaper Car Insurance with CarInsuranceCheck?

Are you looking for ways to get cheaper car insurance?

Here are some tips on saving cash with your insurance policy.

Pay Annually

Paying a lump sum for car insurance cover is cheaper than monthly plans.

Tighten Up

Your Security

Extra security measures can help reduce insurance premiums.

Choose a Less Powerful Car

Buy a less powerful car and avoid car modifications to reduce premiums.

Drive Less Miles

Driving fewer miles reduces the risk of accidents, lowering premiums.

Consider a

Telematics Policy

Telematics policies provide cheaper car insurance for inexperienced drivers.

Pay Annually

Paying a lump sum for car insurance cover is cheaper than monthly plans.

Tighten Up Your Security

Extra security measures can help reduce insurance premiums.

Choose a Less Powerful Car

Buy a less powerful car and avoid car modifications to reduce premiums.

Drive Less Miles

Driving fewer miles reduces the risk of accidents, lowering premiums.

Consider a Telematics Policy

Telematics policies provide cheaper car insurance for inexperienced drivers.

Avoid Auto-Renewal

Auto-renewal might seem convenient, but it's not always the best option for your car insurance for several reasons.

Avoid Modifying Your Car

Modifying your car can indeed have a significant impact on your insurance premiums, often leading to higher costs for a number of reasons.

Car Insurance Quotes Made Simple

The easiest way to compare car insurance quotes and save with CarInsuranceCheck is by utilising our user-friendly online platform.

Simply input your specific details into our intelligent car insurance calculator, and it will instantly provide you with tailored quotes from multiple top insurers.

This allows you to compare various policies side-by-side, enabling you to identify the best coverage and pricing options for your unique needs.

We’re in Business With the Best

Our Clients Arrive Alive & Happy

What Do You Need to Get a Car Insurance Quote?

Providing personal information and documents to get a car insurance quote will help speed up the process and ensure an accurate quotation.

What you’ll need are as follows:

Your Car &

How You Use It

You must provide your car's make, year, model, and registration number.

Your

Personal

Details

You must provide your full name, ID, and occupation, among other information.

Your Driving

History & Licence

A copy of a South African driver's licence and driving record is necessary to check for previous driving offences.

What Do I Need to Get a Car Insurance Quote?

You need to provide some information and a couple of personal documents to get a car insurance quote.

The information provided will not only aid you in getting the quote done faster but assure assure a smooth transaction and accurate quotation.

What you’ll need are as follows:

Your Car and

How You Use It

You need to provide information on your car's make and year model. Alternatively, you need to provide your service provider with the car's registration number if you don't know either.

That's not all...

Additionally, you need to inform an insurer how often you use the vehicle/s you are considering insuring, which will help determine whether you're high or low-risk. The more you're on the road, the higher the risk.

Important Information About Your Vehicle to Have On Hand:

- Make

- Model

- Mileage

- Value of the vehicle

- First year of vehicle registration

- Engine capacity

- Body type

- Fuel type (diesel, petrol, or electrical)

- Stipulate if there are any modifications done to the car

- Number of seats

Your

Details

The following personal details must be provided before any insurance quote can be processed.

Personal Information Required to Process an Insurance Quote:

- Name

- Date of birth

- Address

- Job title

- Marital status

- Licence number

Your Driving and

Your Licence

A copy of your South African driver's licence is required to finalise the quotation process, as well as your driving history. This check is to ensure you haven't been in any recent accidents or if you abide by the laws of the road.

We Can Help You Decide

Then this is the company for you.

Here we, CarInsuranceCheck, will help you find the best car insurance deal for every type of vehicle.

Get outstanding benefits and the lowest premiums.

From bumper bashes, theft, fire, and even third-party claims, get cover for them all.

Old or New Cars, We Can Get Your Vehicle Covered

Classic Cars

Classic or vintage cars can certainly be insured, but they often require specialised policies.

These policies usually agree upon the car’s value at the time of policy inception, recognising the unique nature and often increasing value of these vehicles.

Sports Cars

Sports cars can be insured, but due to their high performance and increased risk factors, the premiums are often higher than for standard cars.

Insurers may also require certain safety measures or secure storage options for these high-value vehicles.

Imported Cars

Imported cars can be insured, but the process might be slightly more complex due to parts availability and maintenance cost considerations.

The cost of insurance for imported cars may also be higher, depending on the car’s make, model, and country of origin.

Modified Cars

Modified cars can be insured, but it’s crucial to inform the insurance company about all modifications.

These modifications can affect the vehicle’s performance, safety, and value, thus potentially influencing the insurance premium.

Electric Cars

Yes, electric cars can be insured.

While the insurance process is generally similar to that of traditional cars, the potentially higher repair costs due to specialised parts and mechanics can lead to slightly higher premiums.

Green Cars

Green cars, including hybrids and other environmentally friendly vehicles, can definitely be insured.

Some insurance companies even offer discounts for these types of vehicles, taking into account their lower environmental impact and often advanced safety features.

What Else Affects Your Car Insurance Premiums?

Insurers consider many factors when determining monthly premiums.

Check out some of the top factors here…

- Car Storage & Security.

- Where You Live.

- Your Job Occupation.

- Your Marital Status.

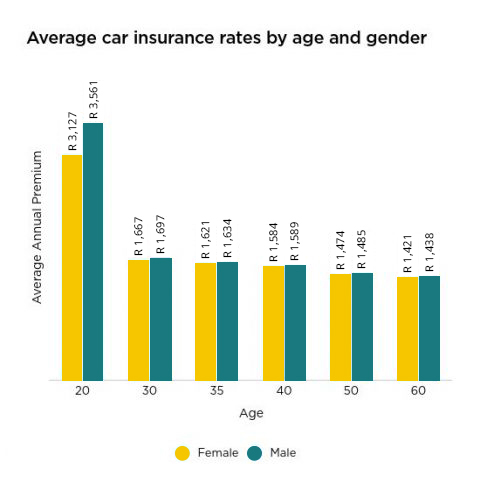

- Your Age.

- Your Driving History.

- Legal Assistance.

- Voluntary Excess.

- Travel Distance (Mileage)

- Type of Car.

- Multiple Drivers on the Policy.

- Claims History.

Expert Guides & Calculators

Lorem Ipsum

FAQ

Didn’t find all the answers you were looking for?

Here are some frequently asked questions you can read for additional information on car insurance:

What’s a Car Insurance Inspection Centre?

A car insurance inspection centre is a facility where vehicles are examined to determine their condition, primarily for insurance purposes.

When applying for a car insurance quote, you must have a full insurance inspection on your vehicle to receive an accurate assessment before getting your written policy from your insurance company.

How Long Is an Insurance Quote Valid For?

Your car insurance quote is usually valid for 30 days, but it also depends on the insurance company and their quotation policy.

In some cases, insurers offer a longer timeframe, while others offer shorter timeframes.

How Long Does Car Insurance Policies Last?

Most car insurance policies last 6 to 12 months, depending on your agreement with your service provider.

How Much Can You Save by Comparing Quotes?

There’s no set amount for how much you can save if you compare quotes and shop around for different providers and their policies.

How you’ll save by comparing quotes is that you’ll find the most comprehensive car insurance that protects all your needs and save on premium rates, which can in turn save you 1000s of rand.

How Many Quotes Should You Compare?

You should compare as many quotes as possible to find the best price and coverage to suit your lifestyle and financial status.

Additionally, comparing multiple quotes will not deter your credit score status.

What Do You Get With Motorcycle Cover?

Generally, all motorcycle insurance covers the costs of liability claims, legal fees, death or bodily injuries, and property damage.

It’ll depend on the limits of the specific policy plan and the insurance company you choose to insure with.

Do You Need Additional Insurance Cover for a Caravan & Trailers?

Yes, you need additional insurance coverage for a caravan and trailer because most service providers seldom cover the costs of damages to your caravan and trailer in the case of an accident.

If you frequently use either a caravan or trailer, it’s advised that you apply for additional coverage.

Is Insurance Cheaper for Women Than for Men?

Yes, car insurance is cheaper for women than it is for men.

This is because women are statistically better drivers than men are, which insurance companies use as one of their validation points to calculate your premium rates when applying for car insurance.

Do You Get Penalised if You Cancel Your Insurance Policy Early?

Yes, you could get penalised if you cancel your insurance policy prematurely, and depending on your policy, it’ll determine what charges you incur on cancellation.

In most cases, if you cancel after the cooling-off period without making any claims, you’ll get charged administration fees.

Can You Protect Your No Claims Discount?

Yes, you can protect your no-claims discount if you’ve chosen to pay a protected no-claims discount.

Even if you have claimed or your insurer recovers the costs from another party, your protected no-claims discount will protect your discount from being revoked.

Does Lower km’s Mean Cheaper Insurance Premiums?

Yes, lower km’s justifies cheaper insurance premiums.

The lower the annual millage is, the better the rate you’ll be paying.

One of the main factors influencing the rate is that the less you drive, the lower the risk of an accident.

Do You Need a Credit Check to get Car Insurance?

Yes, most car insurance companies carry out credit checks in order for you to qualify for car insurance.

They do this to create a credit-based insurance score to help determine your premium rate.

However, if you have a bad credit score, there are some insurers who provide insurance policies without credit checks and charge some of the highest rates.

Will Your Premium Go Up If You Claimed Last Year?

The simple answer to this is yes; your premium will go up if you claimed the year before.

Although some insurance companies boast a “no increase” policy, there will be an increase in your rate.

Only if you can provide enough evidence that whatever the claim was for was not your fault will they consider not increasing your premiums.

How Does Your Job Affect Your Insurance Premium?

Your job affects your insurance premium if you’re more at risk between working hours.

Meaning, if you’ve got an office job, you’ll pay a lower premium compared to a labourer who is exposed to dust, fumes, and other harmful chemicals.

A labourer’s life expectancy is shorter than the average person’s.

Why’s Car Insurance More Expensive for New Drivers?

Car insurance is more expensive for new drivers because they have less driving experience and are a higher risk.

The older you get, the more experience you’ll gain on the road while driving, and insurers take this into account, which is the reason why your premium rates drop over time.

Is It Better to Pay Car Insurance Annually or Monthly?

Yes, it’s better to pay car insurance annually than monthly.

This is because it’s cheaper when you pay one payment upfront with no added extras.

Paying monthly doesn’t split a 12-month bill and incurs extra charges, such as an interest rate.

Which Is the Cheapest Month to Buy Car Insurance?

The cheapest month to buy car insurance is the month before your current policy expires.

In fact, it’s recommended that all renewals be done at least 2 to 4 weeks in advance.

When Could a Claim Be Rejected?

A claim could be rejected for many reasons.

These are some of the main reasons a claim could be rejected:

- A stolen car without a tracker (if the insurer requested a tracker be installed before the event of a theft).

- You cause an accident while driving recklessly.

- Incorrect information supplied on the claim.

- If your claim exceeds your coverage limit.

- If you’ve already exhausted your coverage limit before the claim is made.

- Your policy doesn’t cover the claim being filed.

This is why it’s important to do your research, compare quotes, and go over the finer details of your policy to make sure you’re covered for everything you need to be.

Can My Parents Help Me Get Cheaper Car Insurance?

For your parents to be able to help you get cheaper car insurance, they’ll have to take the policy out on one of their names.

If you’re between the ages of 34 and 75, the premium rates for car insurance are significantly lower compared to a 20-year-old driver’s rates.

What’s a No-Claims Bonus?

A no-claims bonus is a bonus that you’re entitled to if you don’t make any claims for a year.

Here, you’ll receive a percentage discount on your premium the year after, and the longer you don’t claim, the more your no-claims bonus increases.

If you do make a claim, you’ll lose your no-claims bonus, and your premiums for the following year will increase.

Can I Drive Someone Else’s Car?

Although you can get permission from the owner of a car to drive it, it’s not legal to drive another person’s car.

If you want to know if your car insurance covers you when driving another person’s vehicle, check your policy and see if you’re covered for driving other cars (DOC).

Additionally, this is also dependent on the owner’s third-party insurance policy; otherwise, the owner must have your name on their list of drivers that are insured on their policy.

The DOC coverage is only intended to cover you in an emergency situation.

How Do You Estimate Yearly Travel Distance?

You can estimate your yearly travel distance by multiplying your weekly mileage by the number of weeks in a year, which is 52.

For example, if you drive 400 km per week, 400 km x 52 weeks, that would equal 20,800 km per year.

What’s Your Car Worth?

Your car’s age, mileage, and condition will determine its value and worth.

To help get a close enough valuation on your vehicle, there are tools online

Must You Declare an Accident if You Don’t Plan to Claim?

Yes, you must declare an accident with your insurer within a reasonable time.

You, however, don’t need to claim for the accident and must stipulate that it’s for informational purposes only and state that you’re not claiming for it.

If an accident is not declared within a reasonable time, it could result in penalties or a rise in your premiums.

In the News

Our work in the motoring industry has been referenced by over 15 top publications looking for the best advice on the market.

We’re proud of our hardworking team and the work they’ve put in to make CarInsuranceCheck the success that it is.

Take a look at the fantastic references of our content right here!

We hope that you enjoy exploring everything that CarInsuranceCheck has to offer.

Need the Best Car Insurance?

Get the lowest car insurance premiums today from the best insurance companies. We’d love you to try out our service and enjoy the benefit of the best car insurance quotes at the lowest price.

Latest Trending Topics

Learn everything you need to know about car insurance companies, choose the best car insurance option, and stay informed with our latest blog posts here!